hotel tax calculator florida

7 state sales tax plus 1 state hotel tax 8 if renting a whole house. Avalara automates lodging sales and use tax compliance for your hospitality business.

Rental Income Tax Rate For Airbnb Hosts Shared Economy Tax

No additional local.

. TaxAmount 2 Tax Amount 3 Tax Amount 4. City of Miami Beach 1700 Convention Center Drive Miami Beach Florida 33139 Phone. If youre moving to Florida from a state that levies an income.

TaxesSurchargesFees on hotel receipt. Than adding 26250 in taxes for the 125 rate in Orange. Ad Finding hotel tax by state then manually filing is time consuming.

The sales tax rate was last raised in 2003. To get the hotel tax rate a percentage divide the tax per night by the. This is calculated by using 300 7 2100.

You are able to use our Florida State Tax Calculator to calculate your total tax costs in the tax year 202122. 54 rows 125. Avalara automates lodging sales and use tax compliance for your hospitality business.

If youre looking to pass on that beach house in Miami to your heirs you can rest easy. The Florida sales tax rate is currently. 79 rows The state and local tax rate on a poor unsuspecting non-voting tourist can reach 13 when the state 6 sales tax rate is combined with the local rate of up to 7.

The resorttourist tax hasnt changed. Subtract the cost of the room before taxes from the cost of the room after taxes. Contact them at 239-348-7565 for details.

Florida Salary Calculator for 2022. In Arizona certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Some examples are hotel and motel rooms condominium uni ts timeshare resort units single-family homes apartments or units in multiple unit structures mobile homes beach or vacation.

In addition this Bed Tax the State of Florida levies a six 6 Sales Tax on this income. Our calculator has recently been updated to include both the latest Federal Tax. As of December 31 2004 theres no estate tax in Florida.

Hotel tax calculator florida Friday March 4 2022 Edit. Lodging is subject to state sales. Florida has no state income tax which makes it a popular state for retirees and tax-averse workers.

So if the room costs 169 before tax at a rate of 0055 your hotel tax will add 169 x 0055 9295 or an extra 930 per night. This is the tax per night. This is the total of state county and city sales tax rates.

Ad Finding hotel tax by state then manually filing is time consuming. The calculator can be found in the sidebar of each city page. Florida Estate Tax.

The minimum combined 2022 sales tax rate for Tampa Florida is. 7 state sales tax plus 6 state hotel tax 13 if renting a hotel or room. The Florida Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and.

Just enter the five-digit zip code of the. Collection of the Tourist Tax. NA tax not levied on accommodations.

Ie it is in the sidebar for the Orlando page Vegas Page etc. The total cost of booking rises from 268 to 308 after the fee. Including taxes and surcharges.

Overview of Florida Taxes. Hotel tax in Orange County you did post in the Orlando Forum is 65 sales 60 resort for a total of 125. An example of the cost for a week stay at a 300 a night Orlando hotel will be 236250.

The County sales tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. If your hotel is in Orlando FL which is in Orange County FL your hotel cost will be the price of the room plus 65 sales tax 60 resorttourist tax for a total of 125 BTW.

What is the sales tax rate in Pinellas County. Total taxessurchargesfees hotel bill. Every owner of a short-term.

Florida Hotel Tax Calculator Rentals. Tax Amount 1. At most of the Walt Disney World resort hotels the tax is 125 but at the All-Stars the tax is.

55 Sea Park Boulevard 209 Florida Real Estate Florida Living House Hunting

How To Calculate Fl Sales Tax On Rent

10 Creative But Legal Tax Deductions Howstuffworks

Configuring Taxes Taxes Core Concepts Support Ownerrez

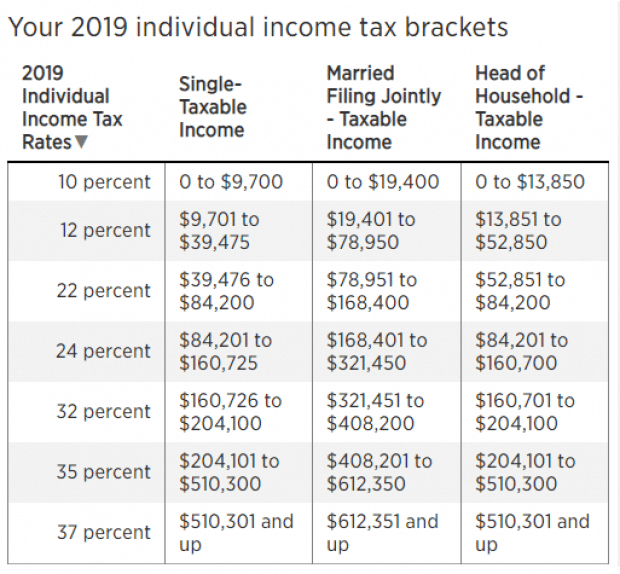

Marginal Tax Rate Formula Definition Investinganswers

Solving Sales Tax Applications Prealgebra

District Of Columbia Sales Tax Small Business Guide Truic

Florida Income Tax Calculator Smartasset

1843 Hancock Bridge Parkway Cape Coral Fl 33990 Century 21 Real Estate Waterfront Homes Selling Real Estate

Florida Income Tax Calculator Smartasset

Texas Sales Tax Calculator Reverse Sales Dremployee

5 Smart Ways To Invest Your Tax Refund Bankrate Tax Refund Finance Investing

Tax Implications Of Canadian Investment In A Florida Rental Property Madan Ca

Charleston Is A Perennial Favorite Of Conde Nast Traveler Readers Regularly Taking The Top Best Places To Vacation Boutique Hotel Charleston Charleston Hotels

Business Owners What Is Your End Game Success Accounting Group Bookkeeping Bookkeeping Services Audit Services