does tennessee have inheritance tax

Those who handle your estate following your death though do have some other tax returns to take care of such. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have.

Tennessee Inheritance Laws What You Should Know Smartasset

Up to 25 cash back What Tennessee called an inheritance tax was really a state estate taxthat is a tax imposed only when the total value of an estate exceeds a certain value.

. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years.

If the value of the gross estate is below the exemption allowed for the year of death. Fourteen states and the District of Columbia impose an estate tax while six states have an inheritance tax. Inheritance Tax in Tennessee.

Was this article helpful. An inheritance tax is a tax on the property you receive from the decedent. According to the Tennessee Department of Revenue.

February 26 2021 1036. It is one of 38 states with no estate tax. Tennessee is an inheritance tax-free state.

0 out of 0 found this. Additionally the Tennessee inheritance tax is now abolished in Tennessee for any person who dies in 2016 or. The inheritance tax is paid out of the estate by the executor.

The inheritance tax is repealed for dates of death in 2016 and after. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. State inheritance tax rates range from 1 up to 16.

Tennessee does not have an estate tax. There are NO Tennessee Inheritance Tax. Technically Tennessee residents dont have to pay the inheritance tax.

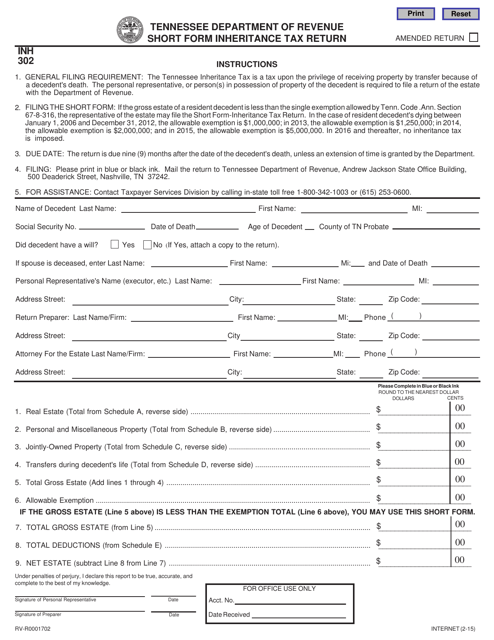

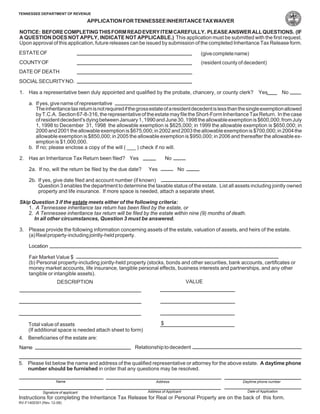

If you pass away in Tennessee with. The Tennessee Department of Revenue has two forms one for estates that are less than 1 million and one for estates that are greater than 1 million. All inheritance are exempt in the State of Tennessee.

However there are additional tax returns that heirs and survivors must resolve for their deceased family members. The inheritance tax is paid out of the estate by the executor administrator or trustee. The legislature set forth an exemption schedule for the tax with incremental increases.

For the purposes of this post we are going to address the last question about Tennessees inheritance tax. IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident. In 2015 the Tennessee.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. Maryland and New Jersey have both. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

The estate tax simply does not impact the vast majority of people. The inheritance tax applies to money and assets after distribution to a persons heirs. If the total Estate asset.

The inheritance tax is levied on an estate when a person passes away. All inheritance are exempt in the State of Tennessee. IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside.

Tennessee is an inheritance tax and estate tax-free state. There is no federal inheritance tax but there is a federal estate tax. The inheritance tax is different from the estate tax.

Under Tennessee law the inheritance tax was actually an estate tax a tax that was imposed on estates that were valued over a certain dollar amount. IT-1 - Inheritance Tax Repealed. Tennessee Inheritance and Gift Tax.

However it applies only to the estate physically located and transferred within the state between. There are NO Tennessee Inheritance Tax.

How To Inherit Retirement Assets In Tennessee

Map Of Earned Income Tax Credit Eitc Recipients By State Teaching Geography Map United States History

Tennessee Inheritance Laws What You Should Know Smartasset

How To Get A Marriage License In Tennessee Zola Expert Wedding Advice

Tennessee Estate Tax Everything You Need To Know Smartasset

The 35 Fastest Growing Cities In America City Houses In America Murfreesboro Tennessee

Tennessee Retirement Tax Friendliness Smartasset

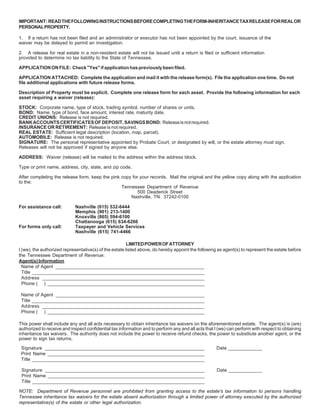

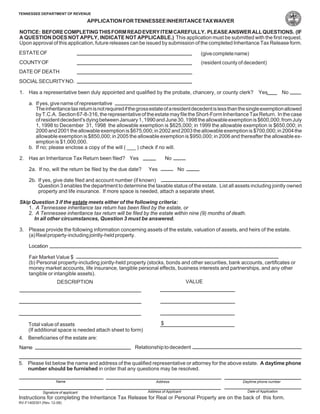

Form Rv R0001702 Inh302 Download Fillable Pdf Or Fill Online State Inheritance Tax Return Short Form Tennessee Templateroller

What You Need To Know About Tennessee Will Laws

Tennessee Estate Tax Everything You Need To Know Smartasset

Historical Tennessee Tax Policy Information Ballotpedia

A Guide To Tennessee Inheritance And Estate Taxes

Tennessee Phases Out Inheritance Tax And Repeals Gift Tax Wealth Management

Divorce Laws In Tennessee 2022 Guide Survive Divorce